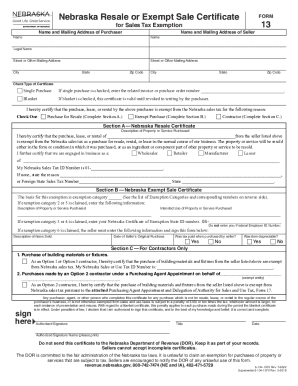

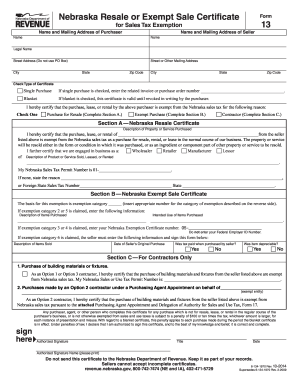

NE Form 13 2005 free printable template

Get, Create, Make and Sign

Editing form 13 nebraska online

NE Form 13 Form Versions

How to fill out form 13 nebraska 2005

How to fill out form 13 Nebraska:

Who needs form 13 Nebraska:

Video instructions and help with filling out and completing form 13 nebraska

Instructions and Help about nebraska tax exempt form

So the focus of the talk this evening is on the relation between Hegel and the recent history of analytic philosophy and also what we should think about the prospects for genuine convergence and cooperation between these two traditions in short how should we view Hegel in relation to contemporary analytic philosophy so on the one handwriting in the 70s but I think continuing to hold the same today the American philosopher Richard Bernstein has offered what might be called the optimistic view which sees hope for ever greater approach mores analytic philosophy itself takes an increasingly regalia turn on the other hand more recently Sebastian Gardner of this parish has argued strongly for the pessimistic view claiming that there are fundamental differences in approach between analytic philosophy and German idealism generally including Hegel and that various attempts by prominent so-called analytic aliens to connect the two are misconceived what we are faced with then in fact is an either-or analytic philosophy or Hegel you can't have both Gardeners claimed in particular, and I'll explain more what this means as we go on is that while analytic philosophy is predominantly naturalistic which again I'll explain as we go on the sort of soft naturalism as he calls it that has been attributed to Hegel is a delusion both interpretive Lee Hegel didn't hold such a view and philosophically and once this is seen through the contrast between the two positions remains stark my own suggestion typically for Nagar liyan perhaps is to try and steer between the two options of optimism and pessimism here that I'm going to try to say that Gardiner is right to criticize the soft naturalism that has been attributed to Hazel but we might be able to attribute to Hazel an Aristotelian naturalism instead which avoids the problems of soft naturalism and give some hope of continuing connection than between Hegel and contemporary analytic philosophy, so the hope is that Hegel's idealism is nonetheless close enough to naturalism to right provide some bridge between Hegel and analytic philosophy but not in the way that Bernstein identifies okay, so the structure of the talk is pretty simple I'm going to talk about the Bernstein optimistic view first then the garden a pessimistic view and then try and steer a middle way between them with my view so let's start with Bernstein the optimistic view and this is sort of derived and obviously then explains my slightly weird title from an article of 1977 in the review of metaphysics entitled by Bernstein Y Hazel now and the article starts as follows during the past decade there has been an explosion of interest in Hegel one can barely keep up with the new additions translations commentaries and articles that have been appearing throughout the world the reasons for this burst of scholarly activity vary in different cultural milieus, but the question is especially perplexing in the context of Anglo-American philosophy if there is one...

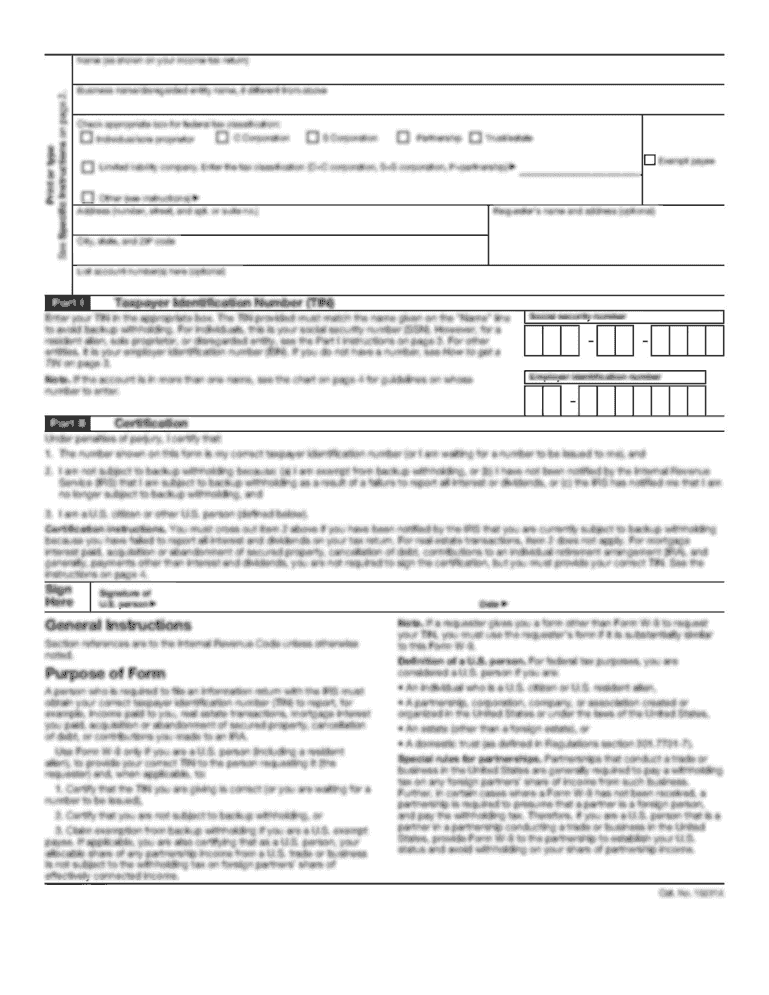

Fill nebraska fillabele form 13 tax exemption : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 13 nebraska 2005 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.